Before leadership. Before institutional responsibility. Before Vision Freedom Academy became a globally recognized name, there was a question that refused to leave Yash Sakpal’s mind: Why does price move the way it does?

While many enter financial markets driven by the pursuit of profits, Yash entered with curiosity. He was never satisfied with signals, shortcuts, or surface-level strategies. What he sought was intent—the logic behind momentum, the structure behind consolidation, and the psychology behind liquidity. That question became the foundation of his journey and shaped every decision that followed.

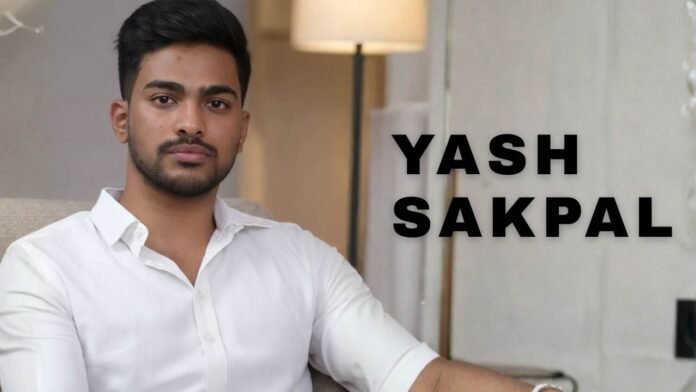

Today, Yash Sakpal serves as the Managing Director and Head of Training at Vision Freedom Academy (VFA). He plays a central role in shaping traders, designing structured training systems, and maintaining institutional standards across a growing global ecosystem. Known for his clarity-driven instruction, disciplined execution mindset, and deep price-based understanding, Yash represents a new generation of trading leaders—built on structure, responsibility, and real-market logic rather than hype.

The Foundation of Mastery

Yash’s professional trading journey was shaped through continuous observation, structured learning, and close mentorship under Jerry Sandhu, Founder of Vision Freedom Academy and architect of its price-driven methodology. Rather than copying trades or chasing outcomes, Yash studied behavior.

He observed how price reacts at key liquidity zones, how institutional momentum builds and shifts, how disciplined risk management creates longevity, and how emotional neutrality separates amateurs from professionals. Through detailed observation and real-market exposure, he began to internalize a critical truth: charts are not random. They reflect decision-making, pressure, and intent.

However, mentorship alone does not create mastery. Execution does.

Five Years of Structured Execution

For over five years, Yash applied price-based principles in live markets. This phase was not defined by excitement or quick wins, but by structure, repetition, and accountability. He refined entries, managed drawdowns, tracked performance, and strengthened discipline through consistent execution.

His focus remained clear:

- Precision over frequency

- Consistency over excitement

- Rules over impulses

Each trade became feedback. Each loss became data. Over time, confusion was replaced by clarity, and emotion was replaced by control. This process built not only technical competence, but professional stability—the foundation required for long-term performance.

The Psychological Shift

One of the most defining moments in Yash Sakpal’s journey came when he recognized that trading success is behavioral before it is technical. Instead of reacting to market conditions, he began documenting himself.

He tracked emotional impulses during volatility, patterns of hesitation and overconfidence, risk misalignment, and inconsistencies in execution. Rather than blaming the market, he optimized his own behavior.

This internal shift transformed him from a market participant into a structured trader—someone who responds logically rather than reacts emotionally. He learned that intelligence does not determine longevity; discipline does.

From Trader to Institutional Leader

As his clarity deepened, so did his responsibility. Working within Vision Freedom Academy’s academic ecosystem, Yash transitioned from a disciplined practitioner into a systems builder—someone capable of translating trading philosophy into structured education.

Today, as Managing Director and Head of Training, Yash plays a strategic role in advancing VFA’s credibility, global presence, and student outcomes. He oversees curriculum development, structured learning paths, student performance growth, mentorship quality, and training discipline standards. His leadership ensures that traders are not merely taught setups, but trained to operate as professionals.

Clarity as a Teaching Standard

One of Yash Sakpal’s defining strengths is his ability to simplify complexity without diluting depth. His teaching is clarity-focused, transforming advanced market concepts into executable understanding.

Under his guidance, students learn how to analyze price objectively, when to trade and when to stay out, how to remove emotion from execution, and how to follow rules under pressure. Confidence is built not through motivation, but through understanding.

Deep Price-Based Understanding

Yash’s strength lies in his deep intuition for price behavior and market structure. He teaches traders to read charts as expressions of intent—understanding momentum, balance, and transition without reliance on indicators or guesswork.

By focusing purely on price, he equips traders with skills that remain relevant across instruments, timeframes, and market conditions. This depth builds independence, allowing traders to think clearly rather than depend on external confirmation.

Focus on Psychology, Discipline, and Longevity

As Head of Training, Yash emphasizes habits over outcomes. He teaches that long-term success comes from behavior that remains stable across changing market conditions. Core principles he instills include discipline over prediction, structure over chaos, risk control for survival, and long-term thinking for credibility.

A Mission Rooted in Clarity

Yash Sakpal’s mission is clear: to build traders who understand price deeply enough to think independently. His journey reflects structured learning, disciplined execution, and earned consistency—where clarity was built trade by trade, and leadership was forged through responsibility.